Information asymmetry has always been a way to make fortunes. From the time where Rothschild Brothers established their information network across five different countries and had pigeons deliver essential information to now wars in wall street in modern times where Hedge funds and trading shops compete in a matter of milliseconds using low latency cables and proximity to data servers.

In the world of blockchain, information is also leveraged to make fortunes. Validators, searchers, and builders possess privileged access to information before a transaction is deemed final. However, if the control over this vital infrastructure remains solely in the hands of these entities, it can lead to potential exploitation and abuse of their privileged positions.

INDEX

The MEV Pie

Consolidation of Powers in The MEV Supply Chain

Within Modular, Across Chains

Flashlights to Navigate The Dark Forest

Fair and Efficiently Private MEV Supply Chain

MEV Not So Bad When You Get It - MEV & AA

Boosting MEV Boost with EigenLayer

Conclusions

The MEV Pie

MEV results from a similar information arbitrage that arises due to the transparent and permissionless nature of blockchains. The composability of DeFi's "money legos" brings surplus creativity allowing developers to construct intricate systems by combining and remixing decentralized protocols. However, this complexity also introduces new risks, one of which is known as the Miner Extractable Value (MEV).

In blockchains, anyone can scan the mempool, which holds unconfirmed transactions waiting to be included in blocks, and seize opportunities and advantages before they are officially recorded on the chain. The extraction of MEV is made possible by the discretionary power granted to miners and validators in the selection and bundling of transactions into blocks and the finalization process. Furthermore, while miners and validators directly extract MEV through transaction and block management, others can also participate in this game by deploying bots, known as "searchers," to explore and exploit opportunities. These searchers often pay higher gas fees to ensure that their exploitative transactions are prioritized, providing benefits to validators. Generalized frontrunners are among the searchers who scour the mempool for profitable transactions, copying and replacing addresses to execute the transaction for their own gain. When multiple individuals compete for the same transactions, they engage in a bidding war by increasing transaction fees, commonly referred to as a Priority Gas Auction (PGA). The mempool is teeming with thousands of MEV frontrunner bots.

Since its was discovered in 2014, MEV has evolved into a multi-million dollar industry and one of the most extensively researched and debated topics in crypto-economics. The growth of MEV is directly tied to the defi TVL and overall activity on the blockchain

Consolidation of Powers in The MEV Supply Chain

Wallets send their orders to builders who need to land a block on the blockchain for the orders to be executed. This can cause delays, affecting user experience and gas fee estimation. Wallets are incentivized to minimize delays by sending orders to builders with the highest inclusion rate, which centralizes power in the builder market, leading to Exclusive Order Flow. Metamask contribute to upto 70% of the transactions in the public mempool. This significant transaction volume and influence in the distribution of transactions could potentially have an impact on the overall order flow.

MEV-boost auctions introduce competition among block builders to extract more value from transactions. However, centralization remains a concern. Initially, Flashbots dominated the MEV-boost blocks, but more builders have entered the market, leading to a more balanced distribution. Nevertheless, centralization persists, with Flashbots and 0x69 accounting for 50% of MEV-boost blocks. Coinbase and Kraken control over 21% of the validator set, indicating further centralization. MEV-boost attempts to address centralization, but large staking pools with more validating power still enjoy advantages, raising concerns about centralization risks.

Around 50% of all MEV-boost blocks have flown through Flashbots' Relay, while BloXroute handled approximately 16%. The concentration of power within these relays became problematic when the US Treasury Department imposed sanctions on the Tornado Cash dApp, leading to censorship of transactions by several MEV-boost relays. The quality of competition in with relayers has been improving and as of May 2023, Ultra Sound Relays process ~34% of total blocks, flashbots is down to ~26%, and Agnostic Gnosis has grown to ~16%.

Validator Centralization has also remained persistent despite the use of MEV Boost. Lido holds close to 29% of the validators and the control held by Coinbase and Binance over 19% of the validator set highlights the centralization at play. The more validators a staking pool possesses, the greater their chances of capturing valuable MEV blocks. While MEV-boost has gained wide adoption and accounts for around 73% of validator rewards, concerns regarding centralization persist.

Although attempts have been made to distribute MEV more evenly, the issue of centralization remains unresolved. Large staking pools with greater validating power continue to enjoy advantages, enabling them to capture more MEV, reap higher profits, and expand their validator count. The dominance of Coinbase and Kraken in the validator set raises red flags about the risks of centralization. Despite limited changes in validator share following the merge, centralization remains a pressing concern, necessitating ongoing exploration of effective solutions.

Within Modular, Across Chains

Modular blockchains offer avenues for optimization across various layers, including block-building techniques and threshold encryption, aiming to reduce MEV extraction. Within these blockchains, MEV is channeled exclusively by execution layers, containing its impact within the execution layer itself. The base consensus layer lacks the ability to actively prevent MEV extraction at the execution layer unless data withholding measures are implemented, which could result in slashing penalties.

Sovereign rollups settle on the roll-up side using validity or fraud proofs, effectively confining MEV within the searcher-builder-sequencer supply chain. Nevertheless, MEV may still trickle down to the base DA layer through fees or priority fees in a first-come-first-serve setup. The extraction of MEV is reliant on the sequencing/block production rules and can be outsourced to the settlement layer or distributed among the sequencing network.

The modular nature of blockchains allows for increased MEV opportunities due to the dissolution of monolithic environments, while also enabling shared layers to coordinate and distribute value. Cross-domain MEV arises when transactions on one chain impact another, leading to MEV capture on the second chain. This necessitates liquidity on multiple chains and introduces pricing complexities.

Atomicity is essential to cross-chain MEV. For MEV opportunities to occur, the cycle must be atomic: something happened or it didn’t. The multi-chain world is not very atomic, which creates all sorts of opportunities for risks that can be difficult to understand, measure, and mitigate.

Atomicity is not available for cross-chain transactions due to different chain validators and block times. Possible solutions are shared sequencers that create atomic transactions for multiple rollups. Another solution for L1s could be SUAVE, where they are trying to build an agnostic sequencer and block builder that is market-based. The key ideas here are shared consensus and atomicity.

Flashlights to Navigate The Dark Forest

MEV Geth

MEV Geth is a modification of Geth, the execution client for ETH. It contains searchers, relays, and validators. The searchers search the mempool for transactions and create bundles of transactions. All these searchers submit their bundles to the relay, which chooses the blocks with the highest bids. The searchers who provided the bundles in the winning block are paid. This was one of the first solutions in the MEV space that quickly reached 80% market share The system relied on a level of trust between the parties to function.

MEV Geth and the Flashbots Relay looked to take PGAs off the chain where they were impacting everyday users and move them to the relay.

PBS - Proposer Builder Separation

In the Ethereum Blockchain before POS, a single entity was responsible for both proposing and building blocks. This means that the entity has the power to choose which transactions are included in blocks and can extract value from the network. PBS aims to address this issue by separating these two roles so the entity proposing blocks cannot see the contents of those blocks. Under PBS, block proposing would be performed by a random validator, as is currently the case. However, the validator would not be able to include any transactions in the block. Instead, they would simply choose the block with the highest bid from a pool of block builders. The block builder would then be responsible for constructing the block and submitting it to the network. In-protocol PBS is still a long way from being implemented.

MEV Boost

MEV boost is an outsourced sidecar for block-building like MEV Geth. MEV Boost is the first instance of PBS that has been implemented and has about 80% market share.

The Builder API in MEV Boost is a modified version of the Engine API used by Beacon Chain nodes to connect execution clients that are responsible for building blocks and consensus clients that are responsible for proposing blocks for addition to the Beacon Chain. Block builders send an ‘execution payload header" - a cryptographic commitment to the block’s contents and total value–to the validator for signing, preventing validators from stealing the block’s content. Afterward, the validator for the next Beacon Chain block, who must have been selected as a proposer, signs the execution payload header with their public key, which is then transferred to the escrow, which passes it to the block builder.

MEV boost also has relays that are trusted third parties that are expected to only provide the headers to the validators and provide them with low latency. In-protocol PBS is the solution that would remove these trust assumptions.

SUAVE

SUAVE will be an independent network that allows any chain to outsource two roles:

Mempool

Decentralized Block Builder

The goal of SUAVE is to be the mempool and block builder for any domain. Aggregating preferences in a single auction has several benefits:

X-chain builders can earn more than single-chain builders.

Efficiency gains from aggregating and clearing preferences in the same auction.

A decentralized and privacy-preserving builder should attract more order flow vs. centralized builders.

Flashbots describes SUAVE as having three components:

Preference Environment - SUAVE Chain and its mempool are specialized to aggregate user preferences from any domain. Users place bids for execution.

Execution Market - A network of specialized “executors” listen to the SUAVE mem pool and compete to execute user preferences.

Decentralized Block Building - Executors can ultimately produce (partial or full) blocks for other domains.

The idea of separating these three parts and creating markets is to ensure the best end result for each different stakeholder. The user gets the best execution and reduction in MEV, the validators get the highest MEV by getting the best builders to build the blocks. Moreover, by being a shared sequencer for other blockchains, it becomes possible to have atomic transactions.

MEV Share

Today, order flow originators like wallets and dapps do not actively participate in MEV. Their users generate MEV when transacting, but this value is captured by builders, searchers, and validators -- not users, wallets, or dapps.

MEV-share is a protocol that enables users, wallets, and dapps to capture the MEV their transactions create.

It uses privacy and commitments to facilitate permissionless collaboration between users/order flow-providers and searchers. It is credibly neutral, permissionless for searchers, and does not enshrine a single block builder. Aggregating order flow to MEV-Share will greatly reduce proprietary order flow as a centralizing force on Ethereum while enabling wallets and other sources of order flow to participate in the MEV supply chain.

Skip Protocol

Cosmos chains like Juno, Terra, Osmosis, and Cronos currently have a first-come-first-served mempool. This means that to win arbitrage opportunities, searchers try to locate their arbitrage bots as close to as many validators and full nodes as possible and spam them with transactions.

Skip uses a Protocol owned builder that is permissionless and fairly captures MEV in-protocol via the auction of bundles. POB can be extended to add custom lanes to the mempool, which allow for a host of functionality like free transactions, custom gas markets (e.g. EIP 1559), and dedicated oracle space.

XATA

XATA creates an unbiased, front-running-free zone with ordered privacy. The design philosophy of XATA is such that it becomes impossible to either inject new transactions into its output, due to signature mismatches or delete ordered transactions, due to transactions being broadcast throughout the network.

Rook

The Rook Protocol is a settlement engine powered by coordination. It receives signed orders or transactions before they are sent to the blockchain, and processes them through a network of Keepers — sophisticated bots that use this information to construct a more profitable transaction, send it to the blockchain, and settle it on your behalf. If the transaction discovers extra profit in the form of MEV, the Keeper shares it with you.

The Rook Protocol is the first protocol that allows generalized MEV to be internalized at the application layer, complementing systems like Flashbots.

Zeromev

The zeromev frontrunning explorer gives clear and detailed visibility of Miner Extractable Value (MEV) and transaction reordering (frontrunning and censorship) on the Ethereum network. They also offer Zeromev-Geth, an alternative execution client for validators wishing to protect users from frontrunning and the network from harmful centralization.

Wallchain

Wallchain integrates with DeFi platforms and helps capture these profits by eliminating malicious bots. The captured profits significantly increase DEX and wallet revenue and help provide cashback to users. Wallchain does this by intercepting the transaction before it is sent to the wallet and simulating back-running strategies. If there is a profitable transaction found, it is sent along with the original transaction, and the profit is returned to the user.

Eden Network

Eden consists of 4 distinct (but related) products for the Ethereum ecosystem:

Eden RPC A set of endpoints that protect Ethereum users from malicious MEV (i.e. frontrunnning, sandwich attacks)

Eden Relay A suite of tools for Ethereum validators and builders to maximize their revenue

Eden Bundles An endpoint for sophisticated MEV searchers to submit bundles to a network of builders

Eden Bundler A NEW public alpha bundler endpoint for wallets, dApps, SDKs, and users to implement Account Abstraction.

Cosmos: Cross-chan Blockspace Market

Cosmos is an internet of blockchains and created the backbone of several important blockchains, including BSC, Polygon, and Cronos. But a common criticism is that the native token, ATOM, does not capture value from Cosmos’ contributions. Recently, members of the community put forth a new proposal that seeks to improve value accrual. One proposal includes an Interchain Scheduler, which creates a cross-chain blockspace market that generates revenue from cross-chain MEV activity.

Eigenphi

EigenPhi is the leading MEV and liquidity data analysis firm, helping you dentify risks, optimize strategies, and improve designs, providing the wisdom of DeFi. It also provides a complete transaction journey map to get insights into token lifecycle.

Fair and Efficiently Private MEV Supply Chain

FHE

FHE is a way to compute encrypted data. This is game-changing. The transaction data can be encrypted and the computation can be run using FHE. This removes trust assumptions from relays and validators' willingness to participate honestly. The current state of FHE technology is not mature enough to be feasible. But with time, we expect technology to play a big role in encrypted mempools.

TEE

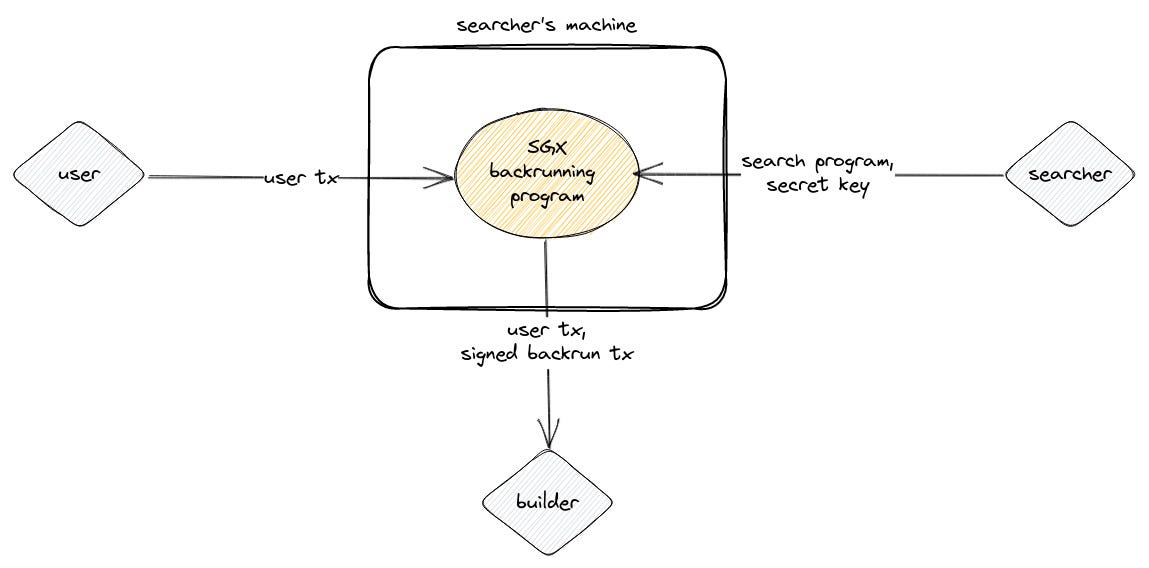

Flashbots again comes with a solution to the back-running problem. They suggest using a TEE like Intel’s SGX. TEE would ensure computation is performed within the secure enclave inside the chip. When a user submits a transaction, the searcher produces a back-run transaction using searcher’s secret key. This back-run transaction with the user transaction is sent to the builder after encrypting it with the searcher’s secret key. To ensure that the user transaction details are not changed, the searcher also uses sMPC. Overall the back-running transactions are good MEV, and by using TEE, the searcher doesn’t have to trust that the validator or relay will use that information to back-run it.

MEV Not So Bad When You Get It - MEV & AA

How would MEV and AA work together?

Currently, only validators and searchers benefit from MEV. Transaction senders, on the other hand, do not benefit from MEV. In fact, they may actually lose money to MEV, as they must pay both the transaction fee and the MEV that is extracted from their transaction.

Transaction senders can use special ERC-4337 wallets called MEVBoostAccount. These wallets allow senders to capture MEV from their transactions. To do this, senders send special userOps called BoostUserOp. These userOps invoke the boost methods of MEVBoostAccount, which allow the wallet to capture MEV from the transaction.

Searchers use a special ERC-4337 paymaster called MEVBoostPaymaster to refund maximum MEV to users by BoostUserOp auction and also pay transaction fees for BoostUserOp.

Boosting MEV Boost with EigenLayer

MEV Boost currently requires block proposers to auction off the right to build the entire block to capture MEV. However, this limits the influence of block proposers in determining the block's composition. EigenLayer can be used to address this issue. Block proposers can stake their ETH with EigenLayer, allowing them to participate in the protocol. Block builders assemble a partial block, either the entire block or a portion, and submit a Merkle root of the included transactions and a bid to a centralized relay.

The relay stores the transactions and shares the Merkle root and bid with the block proposer. The protocol continues with the block proposer selecting the highest bid and assembling an alternative block. The relay releases the transactions corresponding to the winning bid's Merkle root to the block proposer. The block proposer combines these transactions with their own desired transactions for the remaining portion of the block. By leveraging EigenLayer, the protocol introduces a crypto-economic cost to prevent block proposers from stealing the block builder's transactions, ensuring MEV extraction while complying with regulations and addressing liveness concerns.

Additional modifications can be implemented to penalize block builders for building invalid blocks, such as requiring them to restake their ETH with EigenLayer and using fraud proofs to dispute invalid transaction bundles. The upgrade enhances decentralization, empowers block proposers in block composition, and establishes a crypto-economic framework to discourage malicious actions, providing a more robust MEV Boost protocol.

Conclusions

TEE, FHE, and ZKVMs technologies that lead to encrypted mempools protect both the searchers and users while providing maximum profits to the validators. Private mempools will be crucial to improving the user experience in terms of data protection, which gets exploited even before the transactions are finalized.

The proposed upgrade to the MEV Boost protocol involves leveraging EigenLayer to address limitations in block proposers' influence over block composition. This upgrade introduces a crypto-economic cost to prevent theft of block builders' transactions and incorporates additional measures to penalize invalid blocks.

MEV has centralization in its nature, where the validators that have resources, get access to more opportunities, which leads to more resources at their disposal. DVT goes in the opposite direction, where the barriers to participating in the network are reduced. Solutions like markets around block building and proposing, like in protocol PBS and DVT, could reduce the centralization risks in validation.

A lot of questions still remain with MEV for rollups since sequencers have the ordering duty that determines the captured MEV. There has to be an analog of PBS to reduce these effects on the rollup level.